A Look at How the Market Is Starting the Year

I hope 2026 is off to a great start for you! As we move into the first quarter of the year, I’m pleased to share my first market update of 2026, offering a snapshot of how the Victoria real estate market is shaping up after the fast-paced years behind us.

January’s numbers give us a clear sense of where the market is settling — and what that means for buyers and sellers as we move forward.

The short version? The market has cooled, but it remains steady and full of opportunity, especially for those who understand how to position themselves in today’s conditions.

📊 The Big Picture

According to the Victoria Real Estate Board, 339 properties sold in January, which is:

⬇️ 19.7% fewer sales than January 2025

⬇️ 7.6% fewer sales than December

At the same time, inventory increased to 2,624 active listings, up:

⬆️ 3.1% from December

⬆️ 9.6% compared to last year

This places our local market right on the line between balanced and a buyer’s market, giving buyers more choice while requiring sellers to take a more strategic approach.

🏠 By Property Type

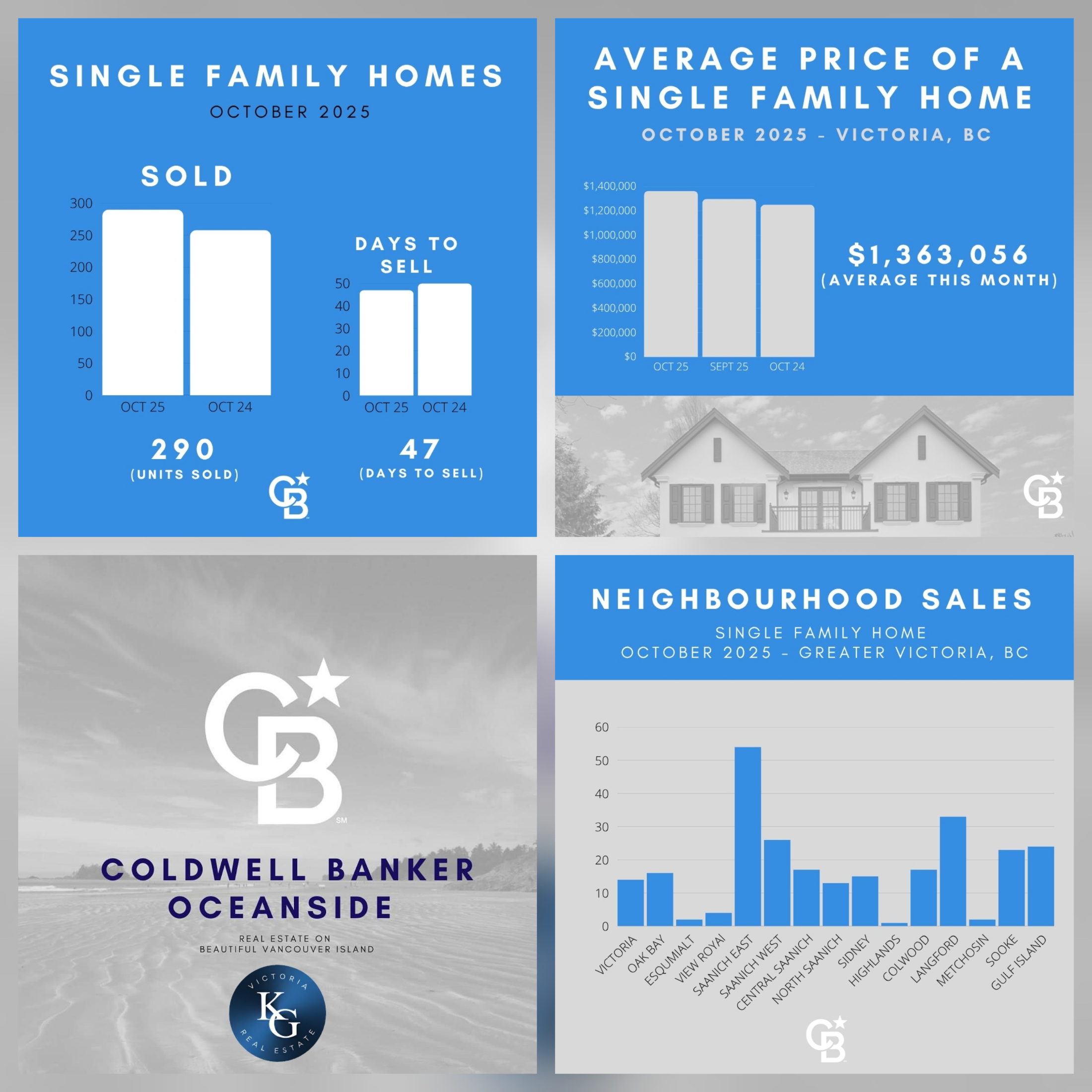

Single-Family Homes

Sales were down 21% year over year

Buyer demand remains, but expectations are higher

Average price: $1,326,911

💡 Homes that are well-presented and priced realistically continue to attract serious buyers.

Condos

Sales declined 25% compared to January 2025

Buyers are more cautious and negotiations are more common

Average price: $667,906

💡 Condos currently offer more choice and stronger negotiating opportunities for prepared buyers.

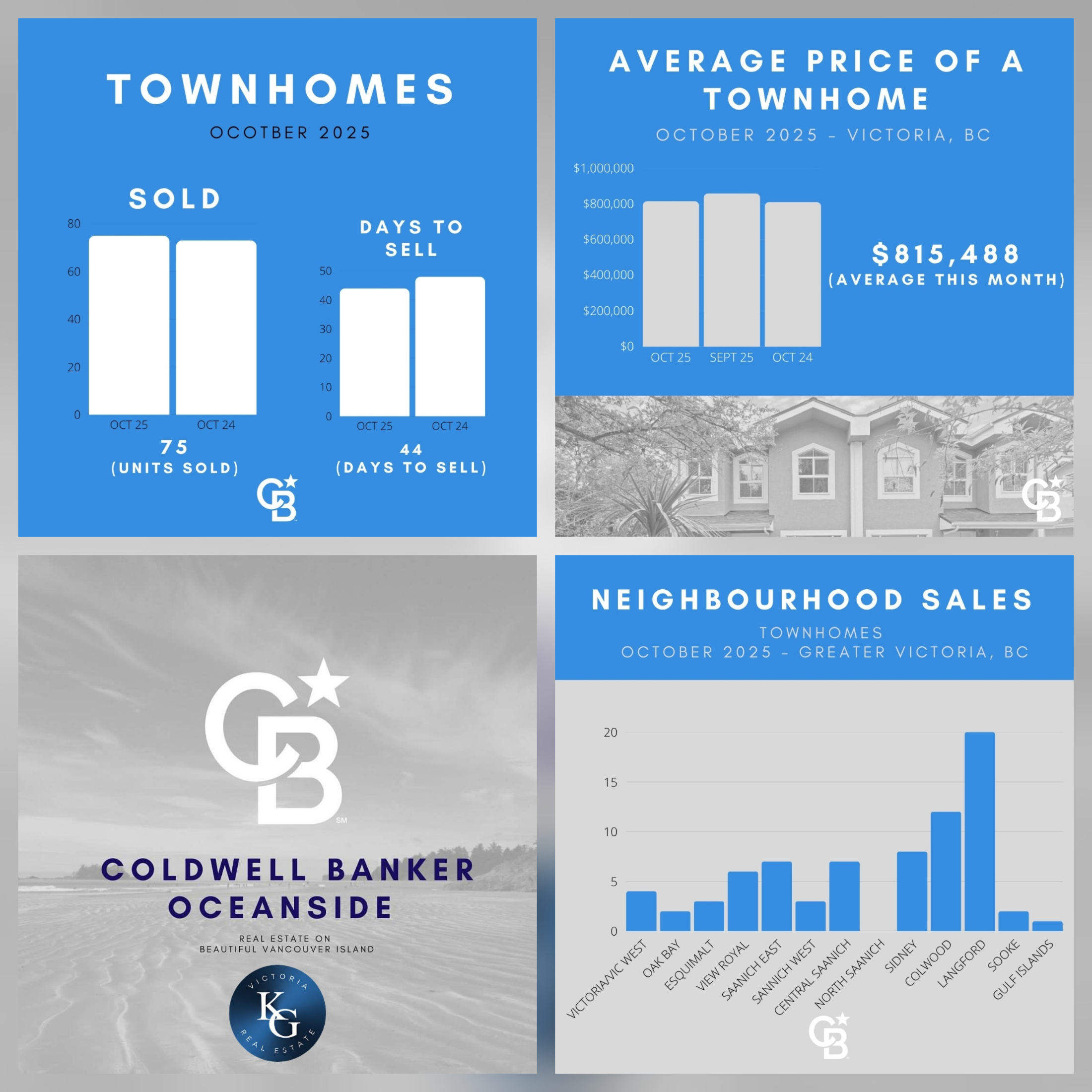

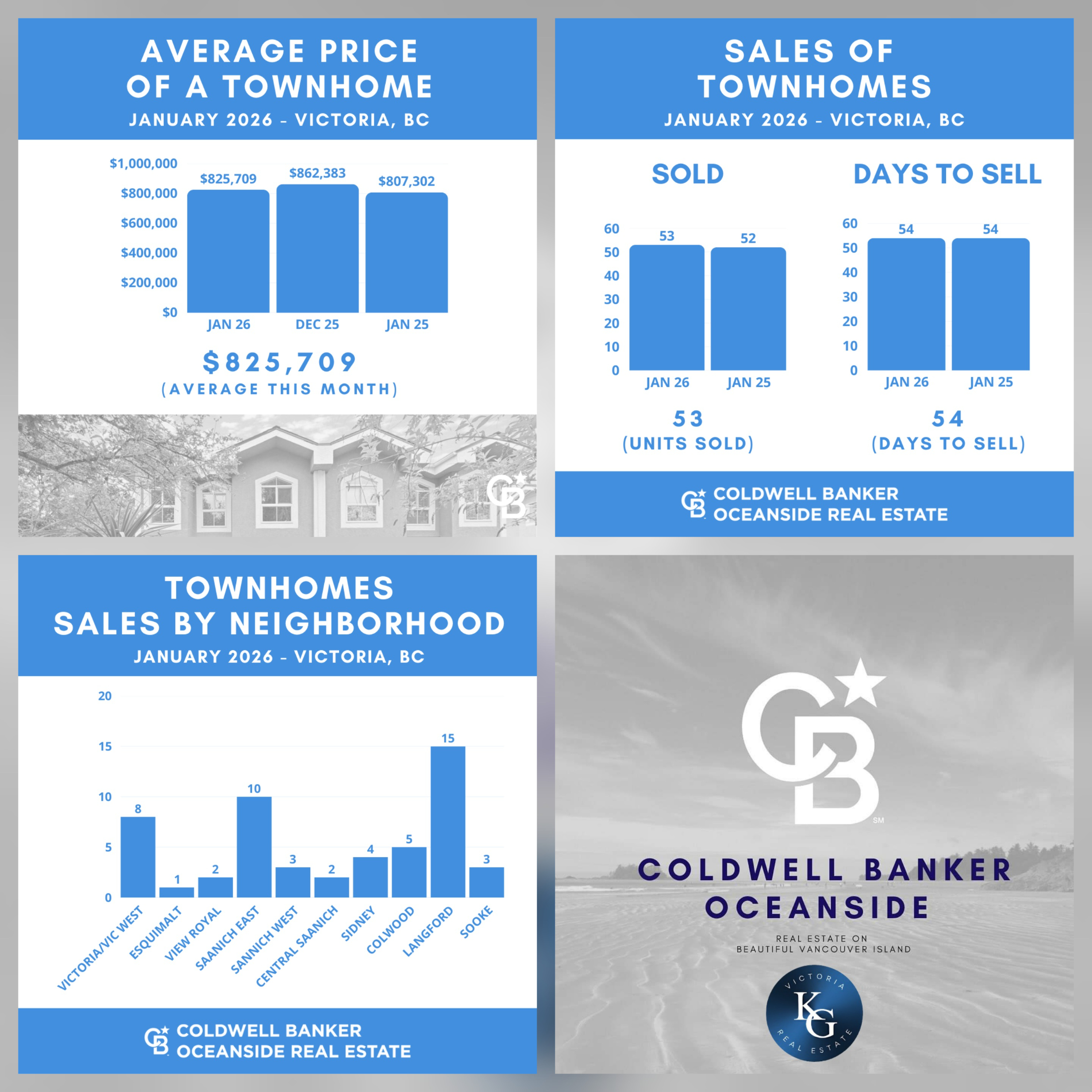

Townhomes ⭐

The strongest-performing segment to start the year

Solid demand driven by space, functionality, and value

Average price: $825,709

💡 Townhomes continue to appeal to a wide range of buyers and remain highly competitive.

⚖️ What This Means for You

For Sellers:

✔️ Strategic pricing is critical from day one

✔️ Buyers are active but highly price-sensitive

✔️ Homes that show well and are priced correctly are selling

❗ Overpriced listings risk sitting and becoming stale

For Buyers:

✔️ Increased inventory means more choice and leverage

✔️ The best-priced homes still move quickly

✔️ Preparation and timing remain key to success

🔮 Looking Ahead

This first update of 2026 reflects a return to more predictable, seasonal market behaviour. Inventory levels are healthier than we’ve seen in years, and pricing has stabilized across most segments. As the year unfolds, factors such as interest rates, consumer confidence, and neighbourhood-specific trends will continue to shape outcomes.

Because our market is made up of many micro-markets, results can vary significantly depending on location and property type — which makes tailored advice more important than ever.

📞 Let’s Talk Strategy

Whether you’re planning a move this year or simply want to understand how today’s market impacts your options, I’m always happy to provide clear, personalized guidance.

Kelly Grymaloski

📞 250-893-9185

📧 Kellyg@ComeSellwithMe.ca